dependent care fsa vs tax credit

Similar to a DCFSA the credit only applies to expenses that are necessary for you to work unless youre disabled or a full-time student. Both give you a tax break on childcare costs but due to different eligibility requirements.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Likely this is AGI from above DCFSA contributions.

. But like the Dependent Care FSA the American Rescue Plan Act ARPA has also increased the credit limits for the Child and Dependent Care tax credit for 2021. Both the Dependent Care FSA and the Dependent Care Tax Credit are limited to the childcare expenses incurred prior to the child turning 13 unless they meet other criteria such as being disabled. If married also include your spouses income.

Both the FSA and the credit results in a 20 tax savings. Dependent FSA vs Dependent Care Credit. Dependent Care FSA.

The child tax credit is 3000 or 3600 for each child dependent on you claim on your tax return. Contribute to Dependent Care FSA DCFSA This is your AGI without DCFSA contributions subtracted from your income. It leads us to have the same conversation every year during open enrollment over whether and how much to contribute to the Dependent Care FSA.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income. This figure accounts for the pre. Its not a straightforward question because theres also the Child Care Tax Credit to consider.

Dependent Care FSA vs. Form 2441 is required to be completed if you had dependent care benefits in box 10 of your W-2. Dependent Care Tax Credit Worksheet.

5000 is the maximum whether for one child or more. Pretax dependent care expenses. Filers could claim up to 3000 of expenses for one child and up to 6000 for two or more resulting in a maximum available credit of 1050 and 2100 respectively.

Form 2441 should be filed along with your 2021 tax return to take advantage of the Dependent Care Tax Credit. Dependent Care Flexible Spending Account Federal Dependent Care Tax Credit 1. Dependent care benefits received from your employer reduces these amounts.

The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA. Approximate value of fully utilizing the Dependent Care Tax Credit in 2021. Now the credit goes up to 8000 for one eligible dependent and up to 16000 for two or more eligible dependents.

If your loved ones has two or extra children and also youve already maxed out your 2021 Dependent Care FSA to the 10500 restrict however your qualifying baby care bills hit or exceed the 6000 cap for the Baby Care Tax Credit score you may reap the benefits of each the FSA and the Tax Credit score. In other words you cant use pre-tax money from your FSA for childcare expenses and then claim the child care tax credit for those same expenses. Child Care Tax Credit You have another option for saving money on dependent care expenses via lowering your taxable income.

Expenses paid to certain care providers are not eligible such as payment to siblings under the age of 19. The child and dependent care tax credit. You can and sometimes should utilize both an FSA and the Child and Dependent Care Tax Credit but you have to keep the dollars separate and the combination cannot exceed the overall expense limits of 800016000.

Depending on their income taxpayers could write off up to. Please add the amount in line 2 or 5000 or 2500 if. The child must live in.

Do you want to save the submit and send it later when you are online. Theres also no income taxes to save on with the FSA but you dont pay SS and Medicare on those dollars so thats the way to go. When you in the deductions and credits section you will need to complete the child and dependent care area.

The form is being submitted. The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more.

As for FSA vs tax credit - you dont pay any federal income tax and the child care tax credit isnt refundable so you wont get any benefit from that. Income Tax Credit. This amount will be used when calculating the credit.

Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. The maximum credit for one child is 3000 per year or 6000 for two or more children not to exceed 6000. You are currently offline and the submit failed.

The form is being submitted. The Baby Care Tax Credit score will solely. The child and dependent care credit and the ability to use an FSA to pay child care expenses has different requirements.

Annual dependent care expenses. Approximate value of fully contributing up to your employers plan limit in a Dependent Care Flexible Spending Account in 2021. Even if things revert back to 2020 rules for dependent care expenses its close to a wash for the first 3k.

Dependent Care Fsa Dcfsa Optum Financial

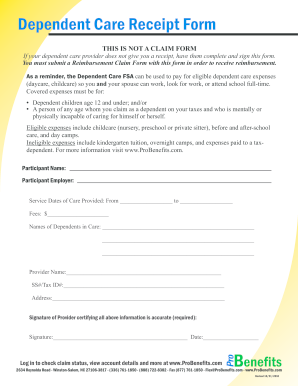

Explore Our Image Of Dependent Care Fsa Nanny Receipt Template Receipt Template Receipt Templates

What Is A Dependent Care Fsa Wex Inc

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa Daycare Costs Affordable Daycare Christmas Savings

Dependent Care Fsa Babysitter Receipt Fill Online Printable Fillable Blank Pdffiller

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

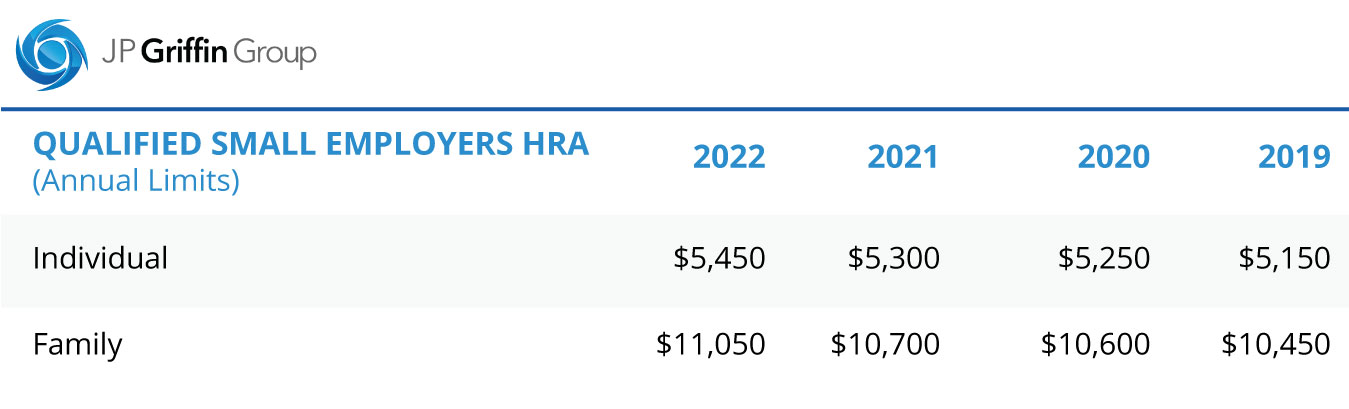

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Optimize Tax Savings From Dependent Care Fsa Child And Dependent Care Tax Credit Video Tax Credits Childcare Costs Tax

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Coh Dependent Care Reimbursement Plan

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning